Pensana’s UK refinery signals growing Western interest in a crucial EV component market, but the path to profitability remains uncertain against China’s dominance.

UK Eyes Slice of Rare Earths Market

The opening of the UK’s first rare earth magnet refinery by Pensana PLC marks a strategic move in the global electric vehicle (EV) supply chain. By targeting neodymium and praseodymium oxide (NdPrO) production, Pensana aims to break into a market essential for the powerful magnets used in EV motors.

Surging Demand, Geopolitical Shifts

The EV revolution has sent the demand for NdPr soaring. Market intelligence firm Adams Intelligence projects an eleven-fold increase in NdPr consumption value by 2035. Pensana’s venture reflects a broader Western push to diversify rare earth supply chains and reduce reliance on China, currently the world’s leading producer of these critical materials. This move aims to strengthen the UK’s position within the EV market while mitigating potential supply chain disruptions.

The Path to Profitability

While the market potential is undoubtedly vast, the rare earth sector presents significant challenges to profitability. Pensana faces the task of overcoming the high initial costs of establishing mining and refining operations. The company must demonstrate its ability to not only produce, but do so at a cost that can generate sustainable profit margins. Market volatility and competition from heavily subsidized Chinese state-backed entities further complicate this landscape.

Key Players and Market Uncertainty

China dominates rare earth production, with giants like China Minmetals Corporation leading the charge. Western players are making inroads, including:

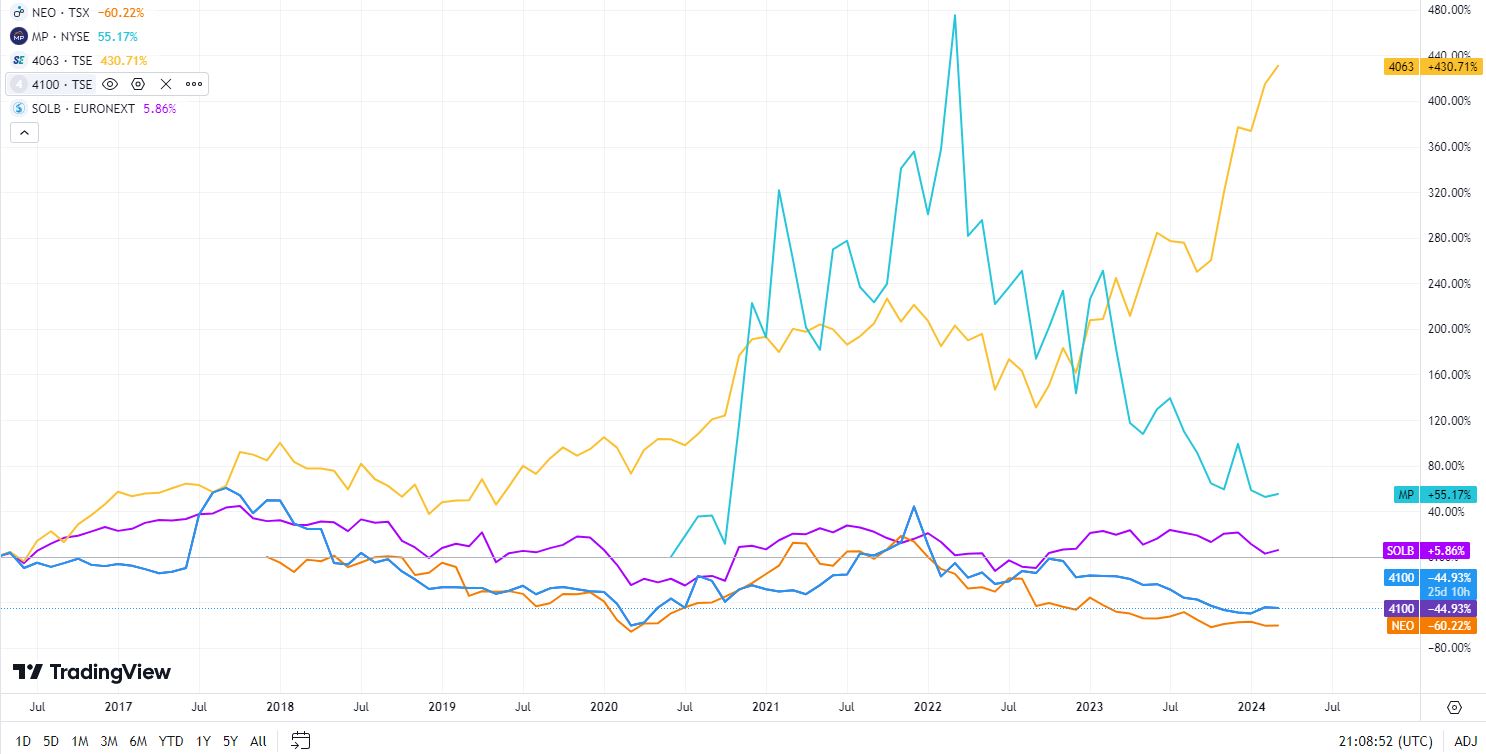

- Lynas Rare Earths (ASX:LYC.AX) – Australian Securities Exchange

- Neo Materials (TSX: NEO) – Toronto Stock Exchange

- MP Materials (NYSE:MP) – New York Stock Exchange

- Shin-Etsu Chemical Co., Ltd. (TSE: 4063) – Tokyo Stock Exchange

- Toda Kogyo Corporation (TSE: 4100) – Tokyo Stock Exchange

- Rhodia Rare Earths:subsidiary of: Solvay (BEL:SOLB.BR) – Euronext Brussels

| Company | Estimated Annual NdPr Production (tonnes) |

| China Minmetals Corporation | 25,000 – 35,000 |

| Lynas Rare Earths | 5,000 – 8,000 |

| MP Materials | 2,000 – 4,000 |

| Shin-Etsu Chemical | 4,000 – 6,000 |

| Magnequench | 1,000 – 2,000 |

| Neo Materials | 500 – 1,000 |

| Others (combined) | 5,000 – 10,000 |

Limited production data, especially from China, makes it difficult to gauge the true competitive landscape. Additionally, despite increasing production, rare earth companies have witnessed a lack of correlation with stock prices, signaling market volatility and potential technological challenges in this complex sector.

Analysis

The success of Pensana’s refinery could prove a bellwether for the UK’s ambitions in the rare earth market. However, investors will remain cautious until the company demonstrates profitability in a field where Chinese dominance casts a long shadow.

Be First to Comment